ERECTION ALL RISKS INSURANCE

- This policy offers comprehensive cover by covering risks which may arise during erection or testing period. It gives financial protection to the engineering contracts in the event of any accident.

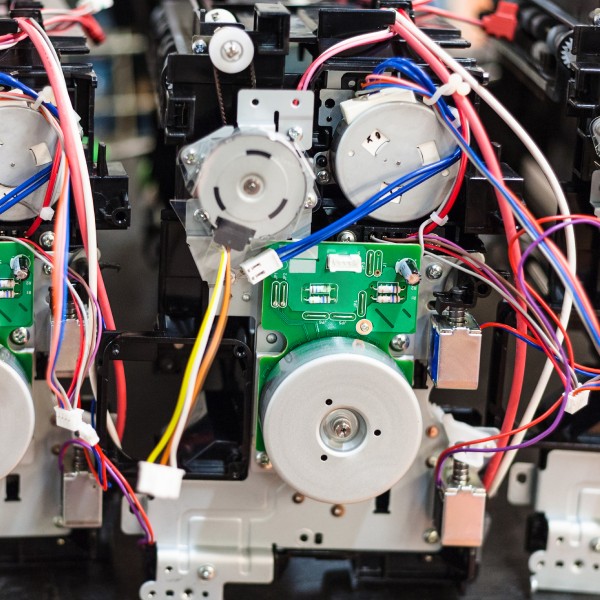

- The Erection All Risk policy is for erection and testing of Manufacturing units or individual machineries.

- The policy also covers legal liability to third parties arising as a result of the project activity during the policy period

- The EAR policy can be availed for the entire project period starting from arrival of material at site and till completion of testing and commissioning

WHAT IS COVERED

All Risks (with certain exceptions) involved during storage, assembly, erection/construction, testing against:-

- Fire, lightning, explosion/implosion, aircraft damage,

- Flood, storm, landslide,

- Theft, burglary, Riots Strikes and Malicious Damage,

- lack of skill, collision, impact, dropping,etc.

- Electrical/Mechanical breakdown during installation or testing

By paying additional premium policy can be extended to cover additional perils/expenses which are mentioned below:

- Earthquake

- Terrorism

- Clearance and removal of debris

- Third party liability cover

- Surrounding property of the insured

- Escalation provision

- Express freight, holiday and overtime rates of the wages –

- Air freight

- Additional custom duty

- Construction machinery plants and equipment

- Maintenance visits cover and extended maintenance cover

WHAT IS NOT COVERED

- War and nuclear perils

- Normal wear and tear, gradual deterioration etc.

- Damage due to faulty design, defective materials, bad workmanship, etc.

- Consequential loss like loss of revenue, penalty for delay etc.

- Inventory losses

- Wilful negligence, and others as per/subject to Insurers policy wording.

- loss of or damage to files, drawings, accounts, bills, currency, stamps, deeds, evidence of debt, notes, securities cheques, packing materials such as cases, boxes, crates

As Insurance is a complex subject, please talk to us now for professional advice and to make sure your level of coverage is appropriate, adequate, and sufficient to your requirements.

The List of Risks or the range of insurances available is not exhaustive, if there are any particular risks that are possibly unique to your type of business and/or for any specific or special requirements, please seek our assistance and guidance.